17 consecutive days of positive realized profit for Bitcoin, the longest streak in a year

- Profit metrics on the chain have picked up as the Bitcoin price has risen

- Net realized profit has been positive for 17 days, the longest streak in a year

- 74% of Bitcoin supply is in profit, three months after it fell below 50% after FTX collapsed and Bitcoin price fell towards $15,000

- Volatility has picked up, but it’s the thin liquidity that’s really helping Bitcoin run

- It has been a great quarter for investors, but there is still danger, writes our analyst

Bitcoin had a forgettable year in 2022 for all the wrong reasons, a price collapse that coincided with several ugly scandals that rocked the cryptocurrency market at large.

So far this year, however, it has regressed. Up 71% as we close out Q1, it is trading north of $28,000 for the first time since June 2022.

Looking at calculations on the chain, the positive feeling is clear.

Net realized profit at one-year highs

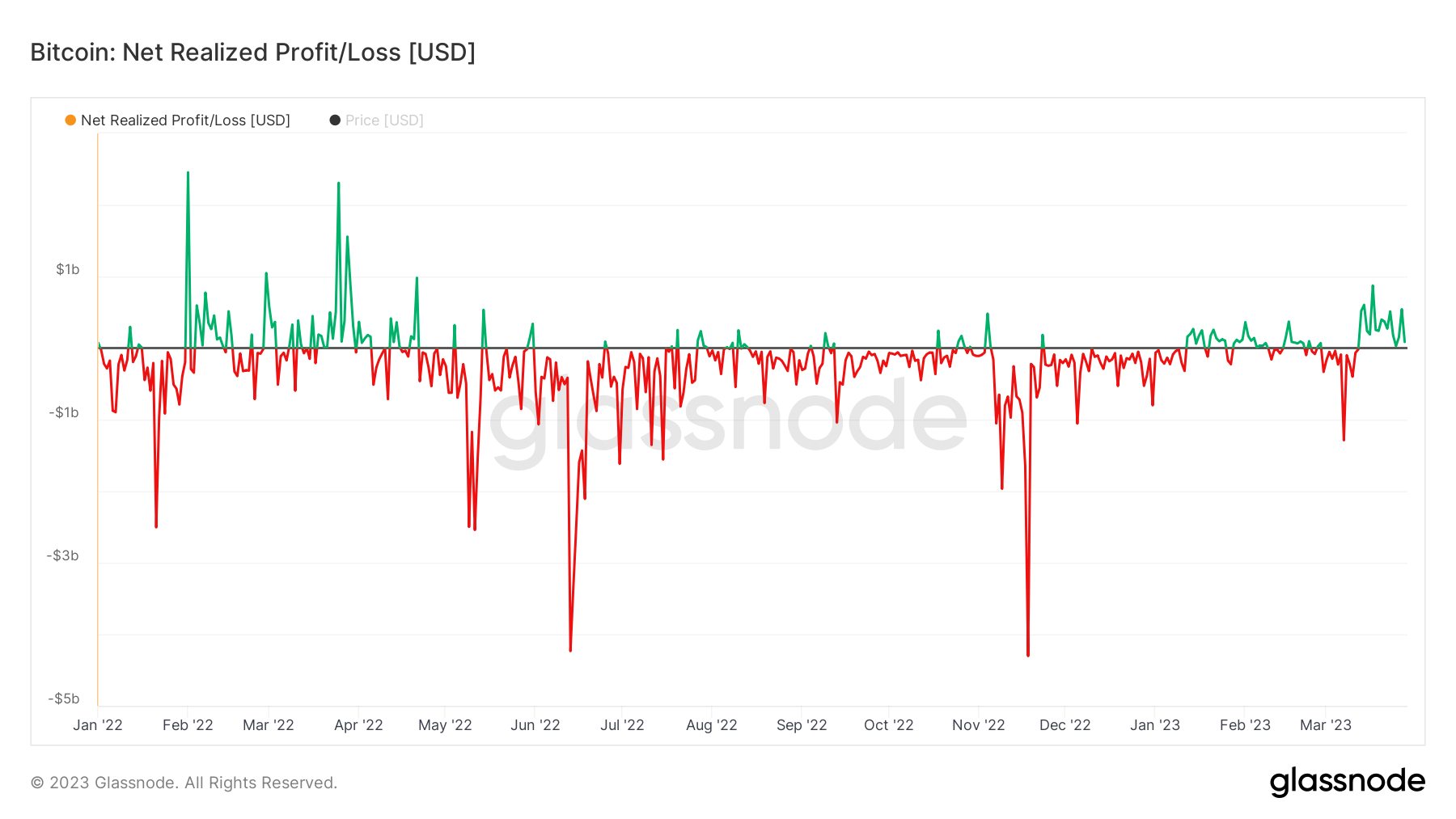

Net realized profit across all coins, meaning the difference between the price a coin moves to and the last price it moved to, is on its longest positive run since this time last year, in March 2022.

For seventeen days now, net realized profit has been positive. In other words, coins move to prices higher than what they were bought for (or the price they last moved to).

There was an 18-day positive streak in late March/early April last year, and beyond that, we have to go back to the fourth quarter of 2021 to see such a streak, when Bitcoin was trading at all-time highs.

Granted, the size of the gains over the past two weeks have not been as outsized as we’ve seen in previous periods, but the fact that it’s a positive run after the year Bitcoin has had is noteworthy.

Three quarters of the offer is in surplus

Another way to see how much things have changed is that three quarters of the total supply is currently in profit.

Right before Christmas, me reported when that number fell below 50%, meaning that for the first time since the brief crash at the start of COVID in March 2020 when financial markets went bananas, the majority of Bitcoin supply was loss-making.

Three months later, the picture is much brighter, with 74% of the total supply now in surplus.

Liquidity remains low as stablecoins fly off exchanges

Interestingly, this increase in prices and profit positions is occurring at a time when liquidity is extremely low in the market.

In a deep dive yesterday I compiled one analysis shows that the balance of stablecoins on exchanges has fallen 45% in the past four months and is currently the lowest since October 2021.

Maybe it’s not a coincidence. The markets are ultra-thin right now, and Bitcoin, which is volatile at the best of times, has found it easier to move aggressively as a result. This also helps explain why it has outperformed the stock market so significantly, despite being so closely correlated with it recently (although some believers claim it is due to bank failures pushing people into Bitcoin, but that feels like a reach) .

Then again, Bitcoin goes to Bitcoin, and the recent volatility is nothing to write home about when viewed historically, although it has picked up compared to the relatively quiet period post FTX collapse.

To wrap this up, it’s been a fantastic few months to kick off the year for Bitcoin, which is a welcome respite for investors who got completely hammered last year. Earnings metrics on the chain have come straight up as sentiment improves and prices jump.

But it is also low liquidity that helps it run up, while the wider economy offers a lot of uncertainty. Sure, it’s a great start, but it’s not out of the woods yet.