$160 million carpet cover? – Crypto Staking Platform Freeway Halts Withdrawals Citing “Unprecedented Volatility”

UK based crypto platform Motorway halted withdrawals on Sunday due to, they claim, never-before-seen levels of volatility – but some claim this is actually a rye pull.

“Has anyone been able to pull out in the last few days,” members have asked in Freeway’s Telegram channel, with many joking that they haven’t – and that they were trying even before Freeway’s notice was published.

Per a message that currently appears on Freeway’s website and which is shared on Twitter,

“As you will all be aware, there has been unprecedented volatility in the currency and cryptocurrency markets in recent times. Freeway has therefore decided to diversify its asset base to manage exposure to future market swings and volatility to ensure the long-term sustainability and profitability of the Freeway ecosystem.”

They claim this will allow Freeway to “maintain the highest level of Supercharger simulation rewards.”

The project promises its users annual rewards of up to 43% with its Supercharger product. It says Freeway Superchargers are “virtual simulations of popular crypto and fiat currencies” and can only be used within the Freeway platform.

The “Risk Warning” page states that,

“Virtual simulation tokens are closed-loop tokens that exist only within the Freeway platform, they cannot be traded on a secondary market, are not obligated to be redeemed or exchanged by Freeway and do not create any economic rights.”

The notice further said that while the above process is ongoing, Freeway will allocate capital to its underlying portfolio and that “for an interim period” and “until our new strategies are implemented,” it will not purchase Supercharger simulations.

It is unclear what these new strategies are.

It added that

“We will notify you when we are ready to resume partial Supercharger simulation purchases (buybacks) and then again as we may resume full Supercharger simulation purchases as well as on-platform Freeway Token (FWT) deposits and purchases.”

Furthermore, the team behind the project said they would not comment further while they complete the process.

This has been another point of discontent in the community, as users said they would prefer to get more information. A member wrote on Telegram,

“While I understand that senior management needs to be careful, I don’t think total silence is a good choice.”

Some even speculated that this choice might somehow be tied to the lender Celsius network and its infamous fall – perhaps Celsius had lent money to Freeway, but others dismissed this theory, arguing that something would have happened soon after Celsius’ bankruptcy.

A rug cover?

While it’s unclear how many actual users suspect something gruesome might be happening here, commenters elsewhere seem to think so.

Popular pseudonymous Twitter user FatMan shared the withdrawal stop news on Sunday, also claiming that the Freeway website appears to be scrubbing the names and photos of some executives.

The Wayback Machine confirms the removal of the ‘Team Freeway’ section of the site, as the 8 managers it lists are no longer listed on the site. And neither is the “Our Partners” section.

Some influencers who previously supported the project reportedly have deleted their tweets about it.

The Freeway website claims to have processed more than $161 million in value, and there have been more than $37 million in annual rewards.

If true, it is unclear how the profits have been made.

Especially FatMan tweeted about the platform also on Saturday, advising users to withdraw their money immediately.

“I think they are running a Ponzi scheme. In my opinion it is likely that Freeway will collapse in the next few months and all depositors will lose everything,” the user said.

The demand came after FatMan had noticed that larger withdrawals were “delayed”. In the post, FatMan lists three arguments that this project is a scam:

- false disclosures on their website,

- shady legal structure,

- unclear strategy for revenue generation.

FatMan claimed that

“Freeway managed to collect $150m+ in user deposits by providing a sense of TradFiesque legitimacy.”

Some online commentators also took issue with the “unprecedented volatility” line in Freeway’s notice, arguing that the crypto market, after its foray into bear territory, has been calm — for crypto, that is.

Bitcoin (BTC), for example, is unchanged in a day, down 1.4% in a week and up 1.8% in a month. It has also traded at around $20,000 since late August.

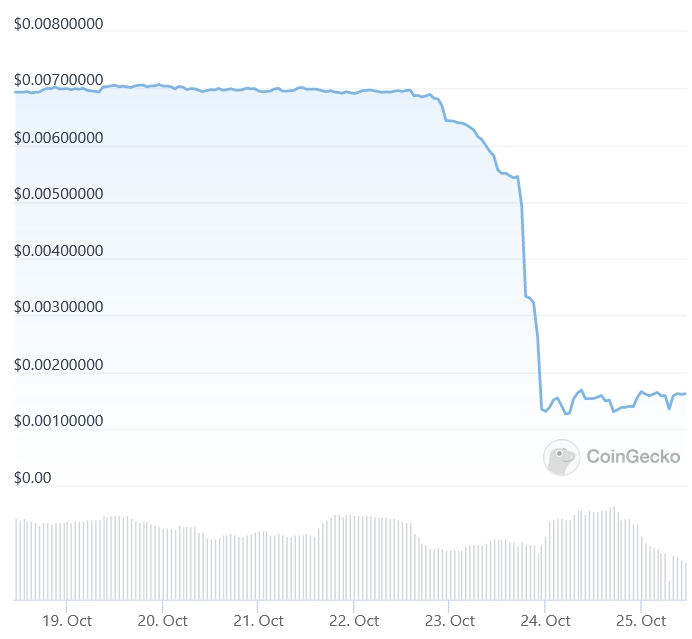

Meanwhile, the project’s native token FWT, 866th by market cap, is up more than 9% in a day and down a whopping 77% in a week. At 8:45 UTC Tuesday morning, it is trading at $0.0016. The coin had seen a major crash on Saturday.

FWT 7-Day Price Chart:

____

Learn more:

– Carpet covers were widespread in August, but somewhat reduced compared to previous months – Report

– GameFi Rug Pull and Accidentally Closed Exchange – Beware of Risks in Crypto

– BTC Mining Pool Poolin Suspends Wallet Withdrawals In Bid To ‘Stabilize Liquidity’

– Give us our money back: the problem of custodial wallets and the implications of stopping withdrawals on Crypto’s reputation